Westfield Councilman Mark LoGrippo recently posted a "Town Update" on his Councilman Mark LoGrippo Facebook page criticizing the actions of his fellow town council members who voted to pass this years municipal budget and a downtown business incentive that would’ve helped Westfield taxpayers.

Westfield Councilman Mark LoGrippo recently posted a "Town Update" on his Councilman Mark LoGrippo Facebook page criticizing the actions of his fellow town council members who voted to pass this years municipal budget and a downtown business incentive that would’ve helped Westfield taxpayers.Town Update:

I hope everyone had a nice Memorial Day weekend and hard to believe we are heading into the Summer months. It has been a long 10 weeks but great to see things gradually getting back to normal. Following are some Town Updates that I would like to share with you.

Town Budget:

I am disappointed that the Town Council approved a municipal budget that imposes the maximum allowable property tax levy increase on residents. Throughout the Town’s 2020 budget process, I expressed my serious concerns with the spending of surplus funds, which are expected to drop to only $7 million at year-end from over $14.5 million only two years ago. I also was troubled by the tax increase on residents who are struggling with the financial challenges caused by COVID-19. Unfortunately, the Mayor and my Town Council colleagues disagreed. In my opinion, Westfield should have joined Scotch Plains, Berkeley Heights, Union County, and many other local governments who did not raise taxes on residents. In addition, residents who commute and pay for the Commuter parking lot should be issued a credit for the months they are not using the parking lot.

Commercial Tax Abatement for Downtown Property Owners:

On first reading the Town Council voted in favor of establishing a tax abatement program for commercial property owners and developers, which can reduce Town revenues and further deplete our surplus. If a homeowner wanted to make improvements to our property, we would endure a tax increase. I voted no as I feel in these trying times, the Town should do more to help Westfield residents financially and not commercial building owners/developers.

Unfortunately, it appears Councilman LoGrippo doesn't want to help the downtown businesses, nor the taxpayers, by gaining additional future revenue which would offset local taxes.

All commercial property would pay the same taxes they currently pay. If a downtown property owner were to make improvements to their property, the increase in taxes above what they currently pay will be incrementally increased in the following manner: Year 2- 20% above , year 3- 40% above. 4-60%, 5-80%, 6-100%.

Example: If the improvements made by a downtown property owner yield a $20,000 tax increase, the property owner would pay only $4000 extra the second year, $8000 the third year, $12,000 the fourth year, $16,000 the fifth year, and $20,000 in the sixth year.

This tax abatement saves the property owner over $40,000 during the first five years after the improvements are made, while still paying the increased property tax as a result of the improvements. The tax abatement saves the property owner money while still contributing more tax to the town which offsets the taxes of the Westfield home owner.

This helps small businesses, property owners, and

taxpayers as it facilitates downtown improvement, which in turn raises the asset

value of the property, which nets higher tax collection from the asset and provides revenue to

offset residential taxpayers costs.

This is a win-win proposition.

We lose nothing, but have the potential to gain more, both esthetically and financially.

Councilman LoGrippo, why would you vote against helping businesses and

Westfield taxpayers? Ask anyone that has moved to Westfield and one of the top three reasons along with great schools and parks is the downtown business district.

Additionally, this year's surplus use is $500,000 less than the

surplus used last year that Councilman LoGrippo so eagerly supported and voted in favor of.

Additionally, this year's surplus use is $500,000 less than the

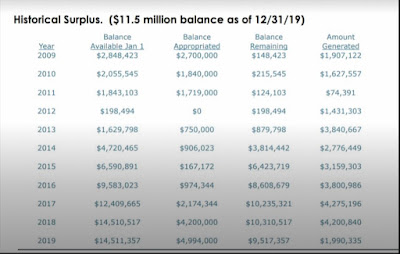

surplus used last year that Councilman LoGrippo so eagerly supported and voted in favor of. Westfield will still have a $7 million surplus with a projected growth likely to boost the surplus to approximately $9 million by the end of 2020. This surplus is more than any surplus held at the end of the year during the first five years of Councilman LoGrippo's tenure on town council.

There is no need for the Westfield tax collector to be acting as a bank account for Westfield taxpayers by over-collecting and having the money sitting in the bank gaining minimal interest when residents could use the extra money in their own pockets during this difficult time brought on by the pandemic.

Councilman LoGrippo has proposed cutting revenue to the town by refunding parking fees paid by those working remotely from home during the pandemic and not using commuter parking lots. He has also suggested lowering the conservation center annual fee due to reduced hours which is currently $60.00.

This reduction in revenue through refunds and fee reductions would cause taxpayers to make up the difference. That difference is what would increase taxes paid by Westfield property owners.

Not one of Councilman LoGrippo's suggestions would have lowered our taxes. In fact, if his recommendations were considered and implemented, they would significantly increase taxes.

Councilman LoGrippo has also suggested a 0% tax increase citing Scotch Plains, Berkeley Heights, Union County and "many other local governments who did not raise their taxes on residents" as an example. Where does Councilman LoGrippo suggest Westfield find the money to offset a 0% tax increase?

Councilman LoGrippo also suggested a deferment of tax interest that by law would

have essentially netted no tax payments required to the town until December 31st, 2020. This would require the town to borrow money to pay the schools, county, library, open

space, and all operational costs of the town.

The interest on that borrowed money/loan would

will be significant and Westfield taxpayers would be responsible for a larger

tax increase in 2021 to pay for it.

While Councilman LoGrippo complains of surplus use, he suggested

spending more surplus to pay for the increase in Westfield's sewer fee which would deplete the very surplus he claims to not want to dip into.

Westfield saw a 0.5% tax increase in 2018, a 0% tax increase in 2019, and a 3 year average tax increase from 2018- 2020 of 0.8%. This 0.8% tax increase over a 3 year period is 50%

lower than the 3 year tax increase average from 2015-2017 which was 1.7% during the last administration.

Councilman LoGrippo voted for those higher tax increases when Westfield had far less surplus at its disposal during the

last administration.

Each of the towns that Councilman LoGrippo suggests Westfield should follow when determining our tax increase, all have a higher three year tax increase average than Westfield has had.

This is not the time for partisan politics.

Dumb as a doorknob

ReplyDeleteMark is our hero. I should invite him for drinks at Shack when it reopens. Oh wait I can’t, I was thrown out for being a lunatic.

ReplyDeleteThe day drinking housewife is a train wreck

DeleteNothing wrong with day drinking. I bring a flask everywhere. I’d drink you under the table anytime anonymous!

DeleteBox of rocks

ReplyDeleteI feel badly for Mike Esposito. Mark jumps in on most photos and takes credits for all of Mike’s good deeds. Same with the Sycamore playground, he was in all the photos but had nothing to do with it. He doesn’t have an original idea ever! What does he actually do for Westfield besides show up for the photo op.

ReplyDeleteThe outcry!

ReplyDeleteTo those police officers who I know regularly read this website...

ReplyDeleteTHANKS FOR ALL YOU DO EVERY DAY.

Please know that MANY of us realize that the vast majority of you (probably at least 99%. Maybe even more than that?) are good people who wake up each and every day, putting your lives at risk, to protect and serve us.

THANKS!!!

Tell that to your elected officials. They only care when the camera is rolling or when it’s convenient for them.

ReplyDeleteEach municipal, county and state law enforcement agency is now required to release the names of officers found to be in major violations with disciplinary actions.

ReplyDeleteDoes that mean all the Dave Wayman cover ups will be brought to light?

Well, allegedly, his mentor Barney Tracy cleaned his file of all matters of discipline to get him past town council scrutiny when he was promoted to lieutenant, captain and chief.

DeleteI guess his thefts from the police department property room as police chief would show up and the accident that he lied about and had Leo Lugo write a bogus hit & run report to cover it up, should show up.

But who knows what the town documented.

In the eyes of former Mayor Skibitsky and town council members that approved Jim Gildea’s recommendation that he be appointed police chief, all think he was a choir boy.

Cop charged with backing police car into parked pickup, then falsifying report. Mddletown, story on nj.com

ReplyDeleteDidn’t someone else driving a town owned vehicle hit a parked car and not report it?

Delete